Pay stubs are an essential part of the employment process, providing crucial information about an individual’s income, deductions, and other financial details. Unfortunately, the prevalence of fake pay stubs has become a growing concern. In this article, we will explore the differences between real and fake pay stubs, the potential consequences of using fake pay stubs, and ways to spot fraudulent documents.

Real Pay Stubs: Accurate Representation of Income

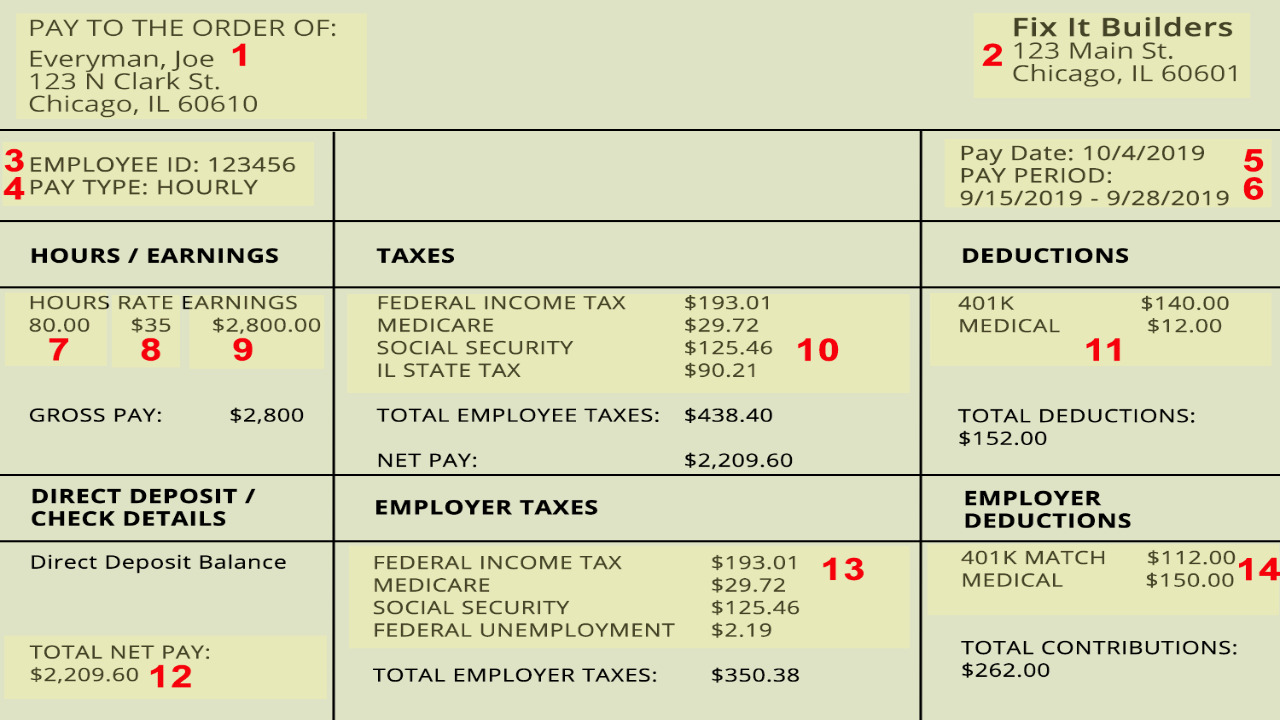

Real pay stubs are legitimate documents provided by employers to their employees, outlining details of their compensation. These documents serve as proof of income for various purposes, such as applying for loans, renting apartments, or obtaining financial assistance. Real pay stubs made through a reliable website typically include information like the employee’s name, employer details, pay period, gross and net earnings, taxes withheld, and deductions for benefits or contributions.

Legitimate Source of Information:

Real pay stubs are generated by reputable employers, ensuring an accurate representation of an individual’s income. These documents are produced using payroll systems, accounting software, or professional payroll services, guaranteeing reliability and consistency.

Compliance with Legal and Financial Requirements:

Real pay stubs adhere to legal and financial regulations. Employers are responsible for deducting taxes, social security contributions, and other applicable deductions. The accurate reporting of these deductions is crucial to maintaining compliance with government requirements and avoiding legal issues.

Fake Pay Stubs: Fraudulent Representation with Serious Consequences

Fake pay stubs, on the other hand, are fabricated or altered documents that misrepresent an individual’s income and financial status. These documents are often used to deceive lenders, landlords, or government agencies for personal gain. However, the consequences of using fake pay stubs can be severe and far-reaching.

Legal and Ethical Implications:

Using fake pay stubs is illegal and unethical. It constitutes fraud and can lead to criminal charges, fines, and even imprisonment. Additionally, it can damage an individual’s reputation and credibility, making it challenging to secure future employment or financial opportunities

Financial Consequences:

Using fake pay stubs to secure loans or credit can lead to financial instability. Lenders and financial institutions rely on accurate income information to assess an individual’s creditworthiness. Misrepresenting income can result in obtaining loans that cannot be repaid, leading to financial distress and a negative impact on credit scores.

Spotting Fake Pay Stubs: A Necessity in an Age of Deception

Spotting fake pay stubs is essential to protect oneself from potential fraud and legal complications. While sophisticated forgery techniques can make it challenging to identify fake pay stubs, certain red flags can help detect fraudulent documents.

Discrepancies in Formatting and Design:

Fake pay stubs often lack the professional appearance and formatting of legitimate documents. Mismatched fonts, inconsistent alignment, or poor-quality printing may indicate a fraudulent document.

Inconsistent Information:

Careful examination of the information presented on a pay stub can reveal discrepancies that indicate fraud. Inconsistent employer details, incorrect tax calculations, or unrealistic deductions should raise suspicion.

Verification with Employers:

Verifying the authenticity of a pay stub with the employer is a reliable way to ensure its legitimacy. Contacting the employer directly and cross-referencing the information on the pay stub can help detect fraudulent documents.

Conclusion

Real pay stubs are essential documents that accurately represent an individual’s income and financial status. Fake pay stubs, on the other hand, can have severe consequences, including legal issues and financial instability. Recognizing the differences between real and fake pay stubs and staying vigilant in spotting fraudulent documents is crucial to protecting oneself from potential harm.